Expanding the Legacy

Corporate Debt Levels Cause for Concern

Economic growth never dies of old age. Its demise requires a clear trigger: an event or mechanism that causes the onset of a slowdown or contraction. Concerned economists have now identified twin triggers in the disconcerting spread of the corona virus and the sudden collapse of oil prices. The OECD...

Whatever Happened to BRICS

Hailed as the portent of a ‘golden decade’ in the flowery language of Xinhua, the China state news agency, the Brasília Declaration promulgated at the close of the last summit of BRICS heads of state or government in Brazil barely received mention in mainstream media. Brazil, Russia, India, China, and...

António Guterres Sounding the Alarm

‘You Are Failing Us’. From Abidjan to Zürich, and Zanzibar to Adelaide, and estimated 7.6 million concerned people took to the street to deliver that unambiguous statement to world leaders gathered in New York City for the UN Climate Action Summit. Between September 20 and 27, well over 6,000 ‘strike actions’ unfolded in 185 countries involving 820 organisations.

Nobody Satisfied: The Perfect Deal in Brussels

The ‘spitzenkandidat’ is dead. Long live the spitzenkandidat? As far as conundrums go, this was a particularly hard one for the European Parliament to consider: vote for and agree with your own demise, vote against and throw a spanner in the works. In the end, a compromise was reached.

Role and Impact of Venture Capital Exposed

Size matters. Two of Europe’s largest new tech firms, Spotify and Zalando, boast a combined market value of some $42 billion – a pittance in today’s world of behemoths. To put things in perspective: China’s Alibaba is worth north of $480 billion whilst the market cap of Facebook hovers around $550 billion. Apple and Amazon are close to the $1 trillion mark.

Mexico Finance Minister Carlos Urzúa: Safe Choice

Mexican Finance minister Carlos Urzúa is not impressed, or indeed intimidated, by the recent surprise change in the outlook of the country’s sovereign credit rating from stable to negative: “This does not constitute a downgrade. The move should therefore be taken with a pinch of salt.”

Seeking to Leave a Mark

To reach the millions of Mexicans ignored by the country’s banking system, the administration of President Andrés Manuel López Obrador in March rolled out a pilot version of a mobile digital payment system that anyone may access free of charge. It facilitates the transfer of funds between users and the payment of bills.

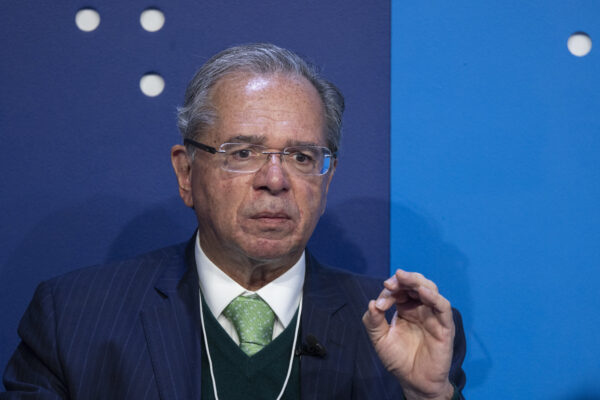

Paulo Guedes: Time for Resolve

Brazil’s all-powerful economy minister Paulo Guedes (69) looks south for inspiration. He has long mulled a Pinochet-style approach to economic management. Mr Guedes is determined to introduce a set of contemporary monetarist policies similar to those that, he says, saved Chile from bankruptcy some forty-odd years ago after a disastrous flirt with socialism – not quite unlike Brazil’s own dalliance with leftist policies.

President Bolsonaro Seeks Early Victory

In Brazil, spending on pensions absorbs fully one third of federal tax revenue. For close to forty years, successive presidents have promised, and failed, to reform the country’s complex pension system which, it is often noted, combines welfare state generosity with pioneer market funding and represents a resilient leftover from the corporatist development model pursued from the late 1960s to the mid-1990s.

The Sense and Nonsense of the Coming AI Revolution

Alas, literature it is not. Shaping the Future of the Fourth Industrial Revolution is, at times, an awkward read held together by the vacuous phraseology much in vogue with upper-management types. After all, what is ‘linear thinking’ and why should it be avoided? Conversely, why must leaders learn how to navigate ‘exponentially disruptive change’, and will they know how to identify such a dreadful phenomenon? However, and thankfully, this is a rather slim volume running just 288 pages. It is also a rather important tome and packs quite a punch, albeit probably not in the way intended. In a nutshell, the message is: society better be prepared to deal with smart machines, powered by artificial intelligence and other marvels of technology.

Just Released

Africa AI Brazil Business Chile China Climate Corona Davos Debt Development Diplomacy Donald Trump Economy Elections Energy EU Europe Federal Reserve Finance France Germany HiFi History IMF Kamala Harris Military Monetary policy NATO Philosophy Politics Putin Russia Schwab Society South Africa Technology Trade Trump UK Ukraine UN US War WEF