Expanding the Legacy

The Tragic Triumph of Hope Over Experience: Great Power Folly

Wars of conquest seldom end well for the would-be conqueror even if waged against a weaker neighbour. Somehow, those to be subjugated always seem to find unity in a resolve to spoil the plans and designs of the aggressor. Their plight is not dissimilar from the one that motivated colonised people to take on the world’s largest empires – and eject them from their native land.

Francis Fukuyama on the Continuation of History

Poor Francis. History didn’t end after all. Neither did liberalism triumph over the forces of evil. Possibly one of the most misunderstood or misinterpreted books of recent times, Francis Fukuyama’s The End of History and the Last Man did not necessarily imply a happy ending to humankind’s convoluted narrative. Rather, Prof Fukuyama argues that, after the inglorious demise of communism, democratic liberalism remains as the only viable political edifice able to promote wellbeing, ensure freedom, and shelter diversity.

Mired in Multiple Crises, Lebanon Votes for Continuity

In a scathing indictment of the country’s political elite, Lebanon tumbled some 25 places on the annual United Nations World Happiness Index and now ranks only above Afghanistan as the most depressed (and depressing) country in the world. Severely dysfunctional states such as Zimbabwe, Venezuela, and Somalia all trump the country formerly known as The Pearl of the East.

Crypto Jitters: Unhinged Stablecoins Add Volatility to Unstable Market

The dig is impossible to resist. On Thursday, tether – the world’s biggest ‘stablecoin’ – briefly became untethered from its dollar peg. Tether’s value sank to 95¢ before recovering to 97¢ That may seem a minor oscillation but indicates a bigger issue that does not bode well. Stablecoins are supposed to be, well, stable and fully backed by readily convertible assets. However, of late, the stablecoin universe has witnessed violent price swings and even implosions. TerraUSD (UST) last week crashed rather spectacularly after some minor initial wobbles not unlike those experienced by tether.

Paranoid and Haunted, President Putin Sees Nazis Everywhere

In President Vladimir Putin’s book everybody not excitedly cheering his ‘special military operation’ to liberate Ukraine is a Nazi. If the Russian press is to be believed, the worse of the lot are to be found in Finland and Sweden as those countries mull joining NATO – the new disguise of the Axis Powers. That blonde on platform shoes from Abba? A dancing Nazi. King Carl Gustav XVI? A royal Nazi. Prime Minister Sanna Marin of Finland? A closet Nazi. Her counterpart in Sweden Magdalena Andersson? A wannabe Nazi. The European Union? A conference of Nazis; and, of course, a thoroughly evil collective supporting its Ukrainian co-conspirator and Über Nazi Volodymyr Zelensky.

Investors Head for the Hills to Find a Valley of Tears

In a bear market, nobody can hear you scream. Equity markets are suffering a crash by stealth with reality nibbling away at asset values. Not long after he slipped into his job, Ben Bernanke, the two-term 14th chair of the US Federal Reserve (2006-2014), called quantitative easing – still a novelty in 2008 – a “great experiment that must be tried.” In the years that followed, the Fed duly flooded the market with an estimated $9 trillion.

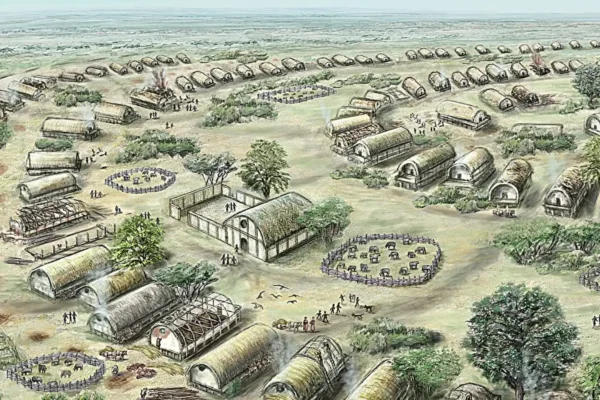

A Non-Linear Anarchist Reading of World History

The conventional reading of history postulates that humankind only embarked on a sustained and rapid trajectory of development after it shed the nomadic meanderings of prehistoric man and settled down to work the land and form communities. This first occurred in the Levant about 23,000 years ago. Here, Neolithic farmers domesticated and cultivated founder crops including barley, lentils, peas, flax, and emmer and einkorn wheat.

Seesawing Stock Markets Rattle Investors

And just like that… the party was over. Wednesday’s stock market rally, sparked by the dovish comments of US Federal Reserve Chairperson Jay Powell, not only fizzled out but reversed with Nasdaq suffering its biggest drop since June 2020.

US Federal Reserve Moves with Cautious Resolve

Markets may have disliked what Jay Powell had to say before; however, what he does now proves a bullseye hit – pardon the pun. The US Federal Reserve surprised no one when, at the end of a two-day policy meeting, its Open Market Committee yesterday unveiled a 0.5 percentage point rise in the federal fund rate. It was the first such robust hike in 22 years and the first back-to-back rate rise increase 2006. Usually, the central bank moves in 25 basis point increments.

Warren Buffett Casts a Vote of Confidence in US Stock Market

A perennial favourite of investors, the snow clone ‘What Would Warren Do?’, has an answer. Warren buys oil and other blue chips that show exceptional generosity towards shareholders. Over the first quarter, Warren Buffett’s Berkshire Hathaway ploughed some $41 billion of its $147 billiion cash pile, mostly insurance float, into the stock market.

Just Released

Africa AI Brazil Business Chile China Climate Corona Davos Debt Development Diplomacy Donald Trump Economy Elections Energy EU Europe Federal Reserve Finance France Germany HiFi History IMF Kamala Harris Military Monetary policy NATO Philosophy Politics Putin Russia Schwab Society South Africa Technology Trade Trump UK Ukraine UN US War WEF