Expanding the Legacy

Tag: Economy

US Fed Celebrates Death of Inflation

The US Federal Reserve celebrated the death of inflation with a bold interest rate cut. As the Federal Open Market Committee mulled its next move during a highly-anticipated meeting yesterday, its twelve members just hoped, and perhaps even prayed (this is, after all, America), that the reports of inflation’s death are not ‘greatly exaggerated’. The benchmark federal fund rate receded to five percent.

Finance Everywhere, But Not a Dollar to Reap

The withdrawal of banks from the high streets and neighbourhood corners is unsurprising. Today, most banks derive no more than three percent of their turnover from ‘traditional’ business operations such as fees and lending depositors’ cash to companies wishing to expand or families looking to buy a home. In 2022, the total assets of the financial sector in the UK amounted to a truly staggering $16.88 trillion - well over five time the aggregate output of the country’s entire economy. Those assets comprise mostly claims on other banks.

The Parallel Universe that Threatens China

Once-upon-a-time it was believed that the prosperity generated by an economy was linked to the measure of freedom a society enjoyed. The belief held that liberal free societies would enjoy a greater growth in prosperity than those ruled by authoritarians. Then China came along and proved all that wrong: growth and affluence could be delivered by a totalitarian regime - and in spades.

The Folly of ESG and Other Hypes

Corporates of all sizes used to crave recognition for their embrace of wholesome ESG values. Environment, Social, and Governance were deemed all important to woo both customers and investors. Promises and commitments were made, examples set, and case stories published - all to great acclaim. Now, just a few years later, the hype has thankfully abated. As a concept or philosophy, ESG has been exposed as mere window dressing. It also proved the downfall of that most maligned of corporate events, the World Economic Forum. The annual fest turned into a platform of smoke and mirrors used by grandstanding CEOs to establish their ESG credentials: they would care for the environment, combat inequality, and offer full transparency - all the while offering investors ever higher returns.

The Great American Economy

Each year in spring, American families spread out impulse buys and other paraphernalia on their front lawn in a ritual known as the garage sale. Neighbours peruse each other’s wares and usually buy as much as they sell. The goods so acquired are stored in the garage which, in the...

On Freeters and Other Exotic Creatures

China, Europe, and even the United States are all said to be at risk of ‘Japanification’: a protracted malaise of low growth, low inflation, low interest rates, and skewed demographics necessitating quantitative easing on a massive scale. A lost decade, sparked in 1991 by the Bank of Japan (BoJ) trying...

After Fiscal Prudence, A Reckoning

In Germany, trains no longer run on time. This is a big issue for a country that derives its national identity from punctuality, order, and ‘Gründlichkeit’ – a thoroughness usually applied in a ruthless fashion. The neighbouring Swiss now refuse to grant late-running German trains access to their network for...

The Mingling of Politics and Business

What goes up doesn’t necessarily have to come down. A case in point: China. The last time the country’s GDP contracted was in 1976 (-1.57%) – the year both Mao Zedong and Zhou Enlai passed away, the Cultural Revolution collapsed with the denunciation and purge of the Gang of Four,...

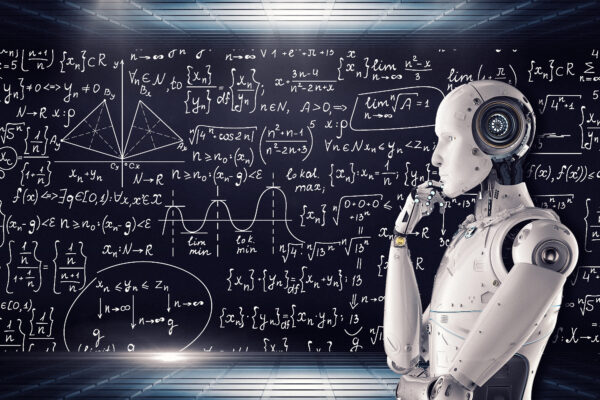

AI to Drive Nail in Coffin of Long Stagnation

Recognised as one of the world’s most prestigious management consulting firms, though no stranger to controversy, McKinsey & Company is quite sanguine about the benefits of artificial intelligence (AI) to the economy. Early adopters of the technology could see productivity gains of up to 25 percent by 2030. Over the...

Seldom Down, Never Out

Echoes of the Franco Era still haunt Spain in subtle and often divisive ways. Now, a vibrant democracy, the country has taken decades to shed its past and rid society of the last vestiges and symbols of authoritarianism. A watershed moment was reached when Prime Minister Pedro Sánchez ordered the...

Just Released

Africa AI Brazil Business Chile China Climate Corona Davos Debt Development Diplomacy Donald Trump Economy Elections Energy EU Europe Federal Reserve Finance France Germany HiFi History IMF Kamala Harris Military Monetary policy NATO Philosophy Politics Putin Russia Schwab Society South Africa Technology Trade Trump UK Ukraine UN US War WEF