Nvidia Share Price Headed to $20K Hazards Top Bull

To the Moon and Far Beyond

Silicon Valley success stories usually spring from garages or living rooms strewn with pizza boxes. Not so Nvidia which can trace its origins to a booth at a Denny’s – famous for the Grand Slam Breakfast served 24/7. In 1993, three electrical engineers met at the restaurant’s Berryessa Rd branch in San Jose to swap ideas about designing a chip to power life-like 3D graphics on a computer. The trio viewed the then-nascent gaming market as a driver of demand.

A company was founded and setbacks duly followed. An eleventh-hour cash injection from Sega America saved the day and allowed Nvidia to develop and launch its first graphics processor unit (GPU) in 1999, the same year it debuted on the Nasdaq exchange. Sold for twelve dollars at the company’s IPO, one Nvidia share bought at the time equals 480 shares today after six consecutive stock splits. Those twelve early 1999 dollar would have grown into almost $700K at today’s valuation.

Professor Hendrik Bessembinder of the WP Carey School of Business at Arizona State University, one of the world’s most renowned financial market experts, calculated that Nvidia created well over $300 billion in wealth, offering investors an annualised return north of 37% since its IPO. Over the same period, the S&P 500, with dividends reinvested, managed to reward investors with average annual returns of about 10.5%.

Over to the Bulls

When it comes to the world’s third most valuable company, with a market cap hovering the $3.2-trillion-mark, the bulls clearly have it. The alpha bull in this arena is without doubt James Anderson, a diligent pupil of Prof Bessembinder, who last year decamped from UK investment manager Baillie Gifford to team up with the Agnelli family of Fiat fame and fortune to launch Lingotto Investment Management which seeks to explore and exploit ‘weird and wonderful’ assets.

Mr Anderson’s claim to fame rests on his ability, uncanny according to his followers/fans, to spot growth potential and pick winners before anyone else catches on. He moved significant chunks of capital into both Amazon and Tesla early on and used periodic stock valuation dips to expand his fund’s holdings – another insight gleaned from Prof Bessembinder’s exhaustive research.

Perhaps keeping in line with Lingotto’s mission statement, Mr Anderson ventures that Nvidia could well attain a market cap of $50 trillion in a decade. Though admitting that his forecast is on the optimistic side, Mr Anderson does present some numbers to back up his claim.

In a letter to investors, he wrote that demand for AI chips is likely to grow by sixty percent annually – the rate at which big data centres are being built. This growth is unlikely to slow down. With unchanged margins, that would translate into a free cash flow of approximately $1,000 per share.

Presuming a five percent free cash flow yield, Mr Anderson concludes that Nvidia shares may be valued at $20,000 a decade from now, pointing to the aforementioned $50 trillion market cap. The present combined market cap of all listed companies in the S&P 500 amounts to $47 trillion.

The Small Print

Mr Anderson provides a few caveats. It wouldn’t surprise him if Nvidia suffered a couple of dips shaving 35-40% off its share price – buying opportunities for the savvy. The fund manager doesn’t think the advent of artificial intelligent is overhyped and emphasises that AI reaches much deeper than consumer-facing applications.

Still, $50 trillion seems like a silly-big number for a single company given that US GDP amounts to ‘just’ $29 trillion. This scenario also presumes that Nvidia’s competitors fail to move onto the company’s turf.

Nvidia’s ‘moat’, though deep and wide, is not an insurmountable obstacle to other mega tech companies. Right now, the company has no real competitors and seems to be going the way of Dutch chip machine manufacturer ASML which also rules its roost without any serious challengers.

However, in a market where bears look wise whilst bulls rake in the cash, Mr Anderson’s numbers offer food for thought. Sceptics argue that, in the end, hardware makers tend to lose out, citing IBM, Nokia, and even Intel as obvious examples. Nvidia is, though, different from the dinosaurs that came before it.

Seven-Year Window

The company offers a full AI stack with its CUDA-X deep-learning software and numerous development platforms. This environment is, at least for now, not easily replicable by others. But, experience (Intel, Microsoft) shows that innovators and disruptors enjoy a seven-year window of absolute dominance before the ‘rest’ gathers speed and catches up. That gives Nvidia another five years until its leading edge runs out. The AI boom took off in late 2022 with the launch of OpenAI’s ChatGPT.

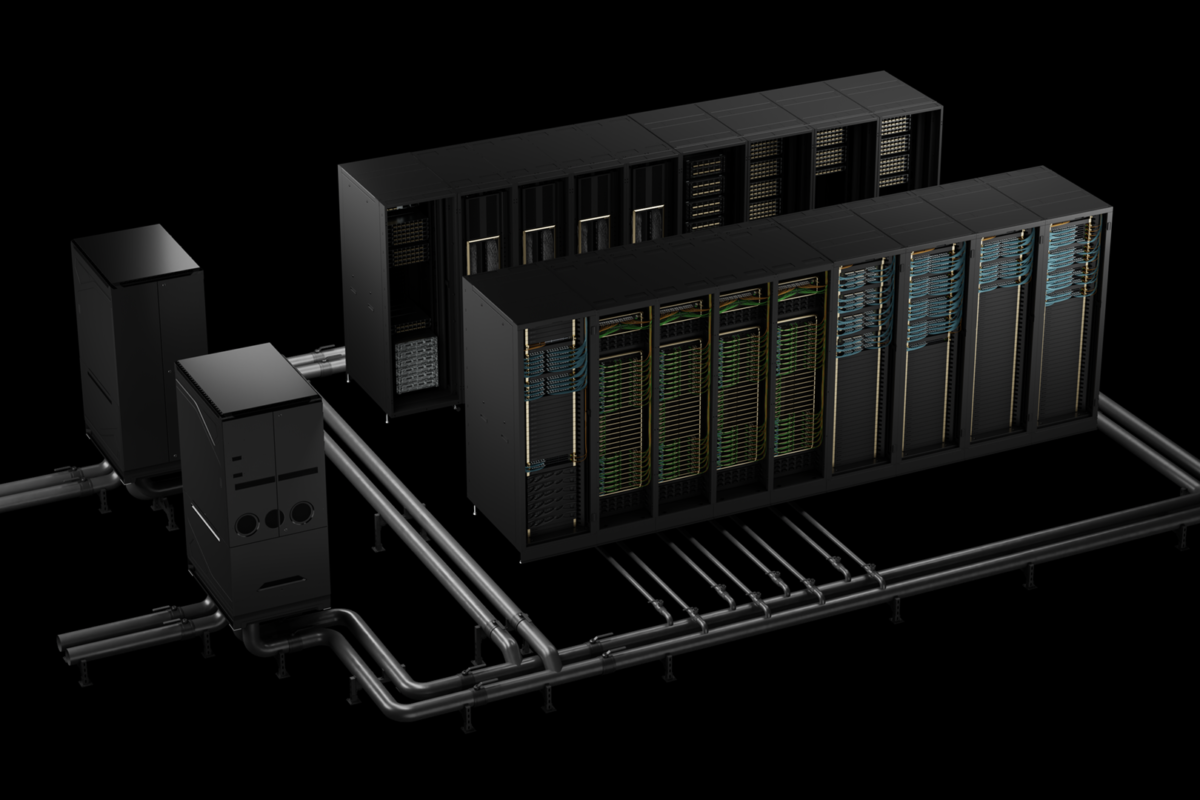

There is some serious incentive to close the gap. Nvidia’s next-gen graphics processor for AI, Blackwell, is expected to cost up to $40,000, similar to the price charged for its predecessor, the H100 ‘Hopper’. According to Jensen Huang, the company’s CEO, some $10 billion went into the research and development of the new chip. Blackwell will start shipping later this year.

Whilst there seem little to no reason to doubt Nvidia’s continued growth and valuation, the dizzyingly stratospheric numbers offered by Mr Anderson as ‘an outside chance’ seem seriously over-the-top. As does, btw, the assumption that corporates will start pouring big money into AI and keep doing that consistently over the next ten years or so. A solid business case for AI has yet to emerge, although it eventually must. However, when that happens one thing may count as a near-absolute certainty: that business case will be unlike anything imagined today.

Cover photo: A Blackwell-Powered AI Factory.

© 2024 Photo by Nvidia