Investors Head for the Hills to Find a Valley of Tears

Brave New World

In a bear market, nobody can hear you scream. Equity markets are suffering a crash by stealth with reality nibbling away at asset values.

Not long after he slipped into his job, Ben Bernanke, the two-term 14th chair of the US Federal Reserve (2006-2014), called quantitative easing – still a novelty in 2008 – a “great experiment that must be tried.” In the years that followed, the Fed duly flooded the market with an estimated $9 trillion.

Mr Bernanke helpfully explained in his 2015 book The Courage to Act that he and other central bankers had no choice but to open the taps: in 2007 and 2008 the global economy teetered on the brink of collapse and flirted with an economic catastrophe that would have paled the 1930s Great Depressions by comparison.

As cash was released, and a crash avoided, euphoria took hold. Asset prices went through the roof in an endless party of self-indulgence fuelled by an insatiable appetite for more. To a collective sigh of relief, the ‘Super Duper Great Depression’ was nipped in the bud. However, the abundance of cash also led to a dangerously inefficient allocation of capital, rewarding speculation and punishing more productive pursuits. Flush with paper wealth, investors large and small counted their riches whilst ignoring the piper and his due.

Anything being traded on or off an exchange surged to dizzying heights. Bitcoin – a fancy tech-driven Ponzi scheme [fodder for a future rant] – was by now supposed to have burst through the $300,000 ceiling. Just about a year ago, hordes of self-appointed and -anointed analysts and assorted snake oil peddlers managed to handsomely monetise FOMO (fear of missing out). There is, btw, a reason why bitcoin miners sell their tokens instantly upon unearthing.

Digital Highwaymen

Countless average Joes and Janes, working stiffs, moved their meagre savings into bitcoin wallets, hoping to catch a ride on the elevator up to that dreamed penthouse. If they did not fall prey to digital highwaymen, they saw their stash shrink at an alarming rate. How could they have known that bitcoin was past its fifteen minutes – and on the way down? The smart money had already moved on. The ‘I’m With Stupid’ t-shirt crowd was left behind.

But that smart money is now quickly running out of places to seek shelter from the gathering storm. Consumer cyclicals are certainly out as inflation bites. Tech is in the dumps and likely to stay there for a while. Financials are neutral at best whilst consumables offer scant protection as household budgets are being squeezed. The energy sector is beset by volatility, seesawing from mania to depression. Given the gung-ho mindset taking hold across the Western world, defence stocks seem a good bet, but don’t expect massive increases in valuation, just steady growth and rising dividends – boring stuff.

Over the last fifteen years, most investors have become speculators, chasing quick returns without much concern for underlying fundamentals and being guided mostly by hype. Now that quantitative easing is being reversed by central banks progressively trimming the heft of their balance sheets, expect quite a few of these ‘investors’ to be embarrassingly exposed as ‘trunkless’ when the waters recede.

Yesterday, the US Federal Reserve thought it necessary to state the obvious: sharp increases in the interest rate pose a risk to the American economy with a ‘higher than normal’ chance of worsening trading conditions in US financial markets.

Who Knew?

After reading and studying their crystal ball, the authors of the Fed’s Financial Stability Report, published twice a year in May and November, gravely conclude that a decline in economic activity can “negatively affect the financial system.” The deep analysis did not stop there either. Higher interest rates and lower house prices, they write, will see a rise in “delinquencies, bankruptcies, and other forms of financial distress.” Who knew?

In a slightly more enlightened part of the report, the Fed warns that tightening liquidity will likely add to price volatility. And indeed, traders have been reporting that even relatively small volumes result in noticeable price swings as markets lose their depth.

As US and global markets suffer the hangover of Mr Bernanke’s experiment, the perfect storm is about to get even more perfect. US retail investors, the very people who collectively own a decisive share of the popular vote, do not hesitate to blame the sitting president for their own follies – or those of his predecessors. The most important job of any US president is to support the Dow Jones – and keep it going.

President Joe Biden’s Democrats seem destined to agonise in the upcoming midterm elections, paving the way for a triumphant comeback of Donald Trump who is fondly remembered by many for cutting to the chase (and exceeding his authority) by telling Fed Chairperson Jay Powell in no uncertain terms to cut the interest rate. Mr Powell, handpicked by Mr Trump to succeed Janet Yellen in 2018, duly complied, although he maintained that a slowing of economic growth rather than a White House ukase impelled him to do so. Right.

A Trump 2.0 administration has now become a distinct possibility where it was a distant one before. That prospect may yet give investors some courage to stage a rally in hopeful anticipation of all the good things to come – or it might dampen spirits as reality sets in and descends on an already unhinged world. In a word: looking for a bottom, markets remain pretty much clueless and investors out of their depth.

One thing is, however, clear: in concert with other major central banks, the US Federal Reserve no longer prioritises market stability – as it did during the financial crisis and the initial stages of the Corona Pandemic – but is now focussed on price stability. And if we know one thing from experience (1970s) it is that once the inflation genie gets out of the bottle, getting it back in requires considerable effort and involves significant pain.

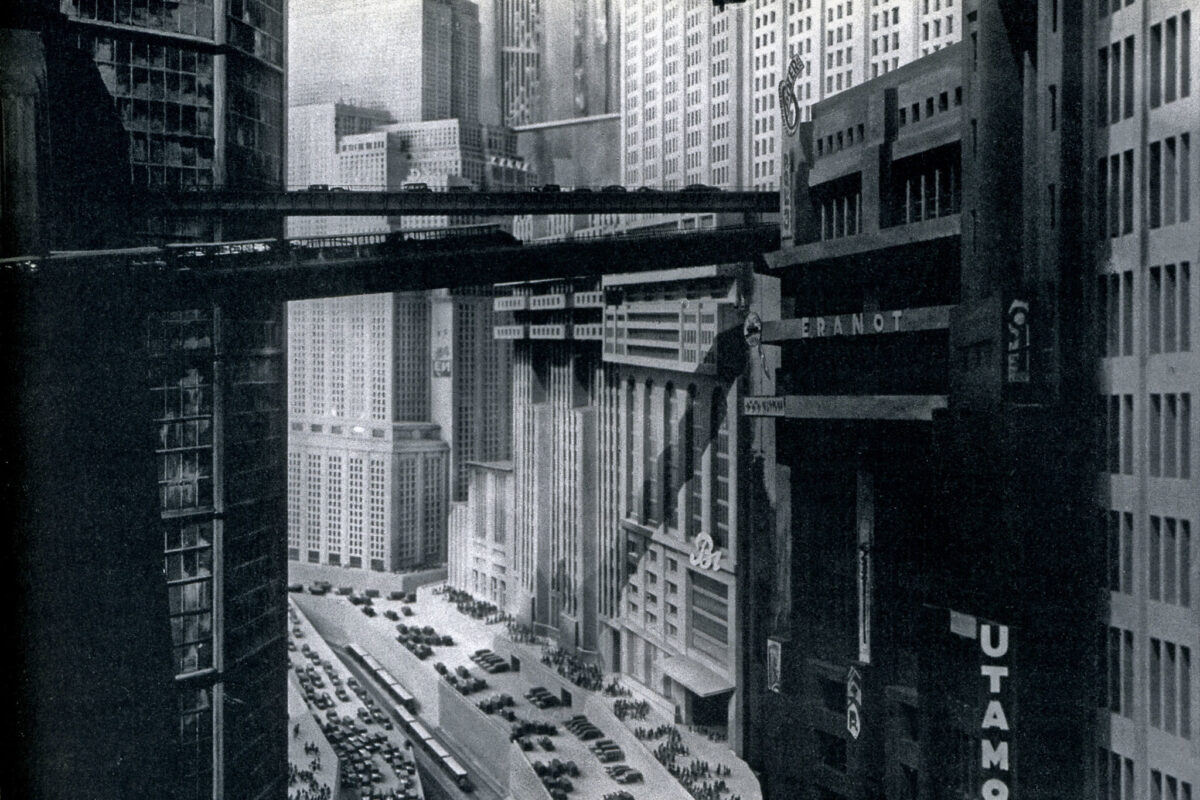

Cover photo: A scene from the 1927 film Metropolis, a dystopian masterpiece by German director Fritz Lang.