Inflation Spike Puzzles ECB

Brave New World

For years on end, central bankers in Europe and the United States have implored providence to deliver a modicum of inflation. Over the past five years, the Eurozone slid twice into deflationary territory. As recently as August 2020, the consumer price index retracted by 0.2% (year-on-year), prompting President Christine Lagarde of the European Central Bank (ECB) to conclude that headline inflation was likely to remain well below the bank’s two percent target for the foreseeable future.

What a difference a year makes: an energy price shock conspired with faltering supply chains and excess liquidity to push annual eurozone inflation to 4.9% in October – a rate not registered since the 1980s and the highest ever since the introduction of the euro in 1999.

Predictably, monetary hawks came out swinging to accuse the ECB of sleeping on the job and not heeding the warning signs. Most analysts now agree that the return of inflation is not merely ‘transient’ as Mrs Lagarde initially predicted. The eurozone core inflation rate – which strips out volatile components such as energy and food – spiked to 2.6% last month – possibly indicating that the headline rate is already feeding on itself through, amongst others, demands for higher wages.

ECB Governors Meet

On Thursday, the 25-strong ECB Governing Council convenes for its periodic monetary policy meeting. The council is widely expected to announce a tapering of its asset purchase programmes. The €1.85 trillion Pandemic Emergency Purchase Programme (PEPP), launched in March 2020 at the height of first covid wave when financial markets went into a tailspin, is likely to end next March. The past few months, PEPP purchases have already slowed from €100 billion in July to €70 billion in November.

The ECB’s more traditional asset purchase programmes (APPs) currently run at a monthly clip of about €20 billion. On Thursday, market analysts will be looking for signs that the bank intends to expand its APPs to pick up the slack and avoid a hard landing. An additional problem is Greece which benefits from PEPP bond-buying but is excluded from APPs that require an investment-grade sovereign debt rating. A solution of sorts is the suggestion that the ECB could reinvest PEPP bond redemptions.

The outcome of Thursday’s meeting is by no means a given. Monetary hawks will likely object to any significant expansion of APPs considering longer-term inflationary pressures. The doves argue that core inflation remains low and pandemic-related risks high. They also warn that abandoning loose monetary policy may undo years of economic stimulus.

The near-term economic outlook for the Eurozone is, in fact, nebulous. Pushed up mainly by household consumption, the zone’s GDP in Q3 grew at a quarter-on-quarter pace of 2.1%. Analysts mostly agree that the tailwinds from the reopening of economies have largely been exhausted as winter sets in and the omicron variant of the virus takes hold, prompting a return of severe restrictions. Persistently high energy prices, up on average 27% since November 2020, and tensions with Russia further murky the waters.

Calibrated Response

EU Economy Commissioner Paolo Gentiloni called for ‘carefully calibrated’ policies to meet the gathering headwinds. Mr Gentiloni cautioned several member states (Belgium, France, Italy, Spain, and Greece) to watch their national debt which ballooned during the pandemic. He also called on member states to make full use of the EU’s €724 billion recovery fund whilst urging governments to move spending away from emergency measures and towards projects that improve economic resilience.

The Commission is currently in its ‘European Semester’. This is when it tries to coordinate policies across the region. However, the bloc’s fiscal and debt rules have been suspended until 2023, limiting Brussels to merely dispensing (unsolicited and non-binding) advice on the spending policies of member states. Mr Gentiloni said that dealing with the emergency was probably easier than returning economies to ‘normal’.

That feeling is shared by the ECB in Frankfurt which also seems rather clueless about the economic resilience of the eurozone. When in doubt, kick the can down the road. Whilst Thursday’s meeting may produce fireworks behind closed doors, drastic changes to present policies are not likely to result. Moreover, Mrs Lagarde has all but discarded interest rate hikes for 2022. Markets are not about to challenge her on that. Swap rates, particularly after the appearance of the omicron virus strain, indicate that markets do not expect any rate moves before mid-2022. The ECB deposit rate stands at -0.5% since 2019.

Concerned Central Bankers

Outgoing Bundesbank President Jens Weidmann, who on Thursday attends his last ECB Governing Council meeting, clashed publicly with Mrs Lagarde over the need to tighten monetary policy to choke off inflation – the German’s and his country’s long-time bugbear. Mr Weidmann also repeatedly warned that asset purchases can become an ‘addictive habit’ and pleaded for ECB monetary policy to ‘get out of crisis mode’.

With Mr Weidmann’s imminent departure, Dutch Central Bank President Klaas Knot is likely to slip into the position of leading face amongst the ECB hawks. Mr Knot favours ending the PEPP no later than March next year and is concerned that the uptick of inflation may be considerably less transient than expected. He is also reluctant to green light an expansion of APP bond purchases.

Mr Knot is, however, not much concerned about the pandemic’s potential for continued economic disruption and seems confident that the omicron strain will not cause havoc – or, indeed, derail the Eurozone economy: “Each successive wave has less of an impact. Both businesses and households apparently have found ways to work around lockdown restrictions.” The time seems right for the ECB to do likewise and trace a path back to normalcy.

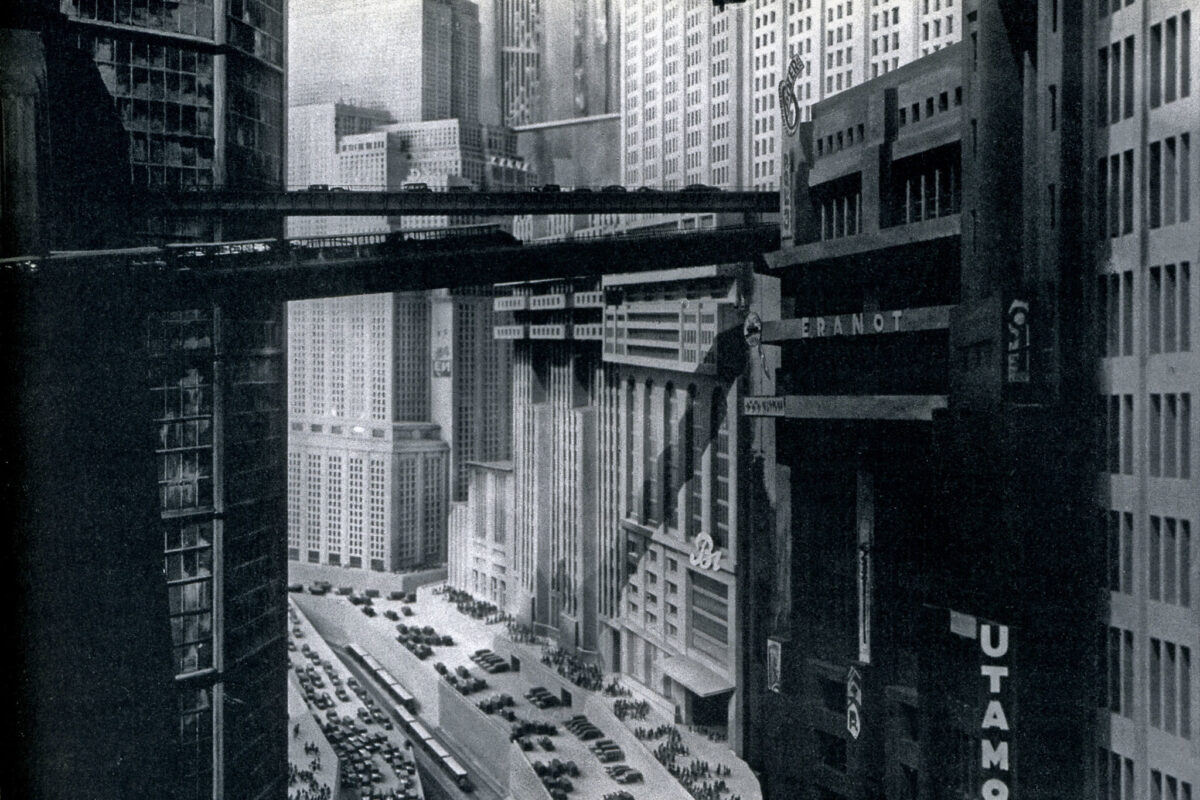

Cover photo: A scene from the 1927 film Metropolis, a dystopian masterpiece by German director Fritz Lang.

© 2018 Photo Klaas Knot by Deutsche Bundesbank