Expanding the Legacy

Lawyers Needed to Rein in Altman and Co

More than technology, Silicon Valley produces hype. It is forever on the cusp of a major breakthrough, needing only a bit more cash for the magic to happen. In the 1990s it was the dot-com boom; in the 2000s nanotechnology; and in the 2010s blockchain and its crypto derivatives. All these hypes promised deliverance from some affliction suffered by mankind and usher in an era of peace, prosperity, and general wellbeing. The paperless office and global village came and went, as did the miraculous nanotech materials and all the pyramids that touched the heavens unlocking vast wealth to believers. More often than not, Silicon Valley offered solutions in search of a problem.

How Silicon Valley Strikes Out, Dumps VC Funds, and Woos You

The job of venture capital (VC) fund managers involves making out with lots of frogs in the expectation that at least one of them turns into a prince. VC funds have enjoyed a great ride with a powerful business model that not only provided good returns but one with significant benefits to society as well. VC brings innovation and enables bright minds and lateral thinkers to prosper. Its absence is often mentioned to explain the dearth of tech champions in Europe. However, in the era of generative-ai capital is required on a much grander scale than VC can deliver.

The Sense and Nonsense of the Luddites

Luddites thrive on nostalgia and a fear of technological progress. However, before dismissing them as sentimental fools, it would be wise to consider a few of their more reasoned arguments, especially in light of the advent of artificial intelligence. To some, AI is but the latest iteration of the much touted ‘paperless office’, the big promise of the 1980s which never quite materialised. In fact, the world’s offices are inhabited by more paper shufflers than ever before.

Clearview AI Phishes in Murky Waters, Catching Multiple Fines

Smile. You’re on camera. On Tuesday, the Dutch Data Protection Authority issued a €30.5 million fine to Clearview AI, a US corporation that scrapes the internet to gather photos and data of people. The company is not just interested in miscreants but casts a wide net and essentially wants to include everybody, preferably all earthlings.

Trapped in Space Waiting for Elon

US astronauts Barry Wilmore (61) and Sunita Williams (58) are having a ‘Major Tom’ moment aboard the International Space Station (ISS). They arrived on June 6 for an 8-day mission but became stuck in space after their Boeing CST-100 Starliner spacecraft suffered a malfunction with its helium-powered thrusters. Already stranded for two months, the astronauts may have to wait until February - another six months - for a ride home. Yesterday, NASA suggested it may turn to SpaceX for help.

Finding, Dissecting, and Dealing with AI Hallucinations

Artificial Intelligence (AI) is taking over the internet with untold millions of webpages generated by bots at the request of entrepreneurs looking to ‘get money for nothing’ - if only because the ‘chicks’ are not usually ‘free’ for nerds. It is a great business by any standard. Ask any bot powered by a large language model (LLM) to write a few hundred words on any given topic and a webpage is born. No need to hire and pay writers, editors, proofreaders, or any other creative professional. What’s not to like?

Nvidia Share Price Headed to $20K Hazards Top Bull

Mr Anderson ventures that Nvidia could well attain a market cap of $50 trillion in a decade. Though admitting that his forecast is on the optimistic side, Mr Anderson does present some numbers to back up his claim.

AI Gunning for the Corner Office

MBA graduates are usually highly valued for their ability to analyse and comprehend a vast universe of business scenarios, discern trends, trace the shortest route to success, unearth synergies, and/or map under-explored areas ready for exploitation. However, there is quite literally nothing in this that cannot be done by artificial intelligence - and probably be done better and cheaper.

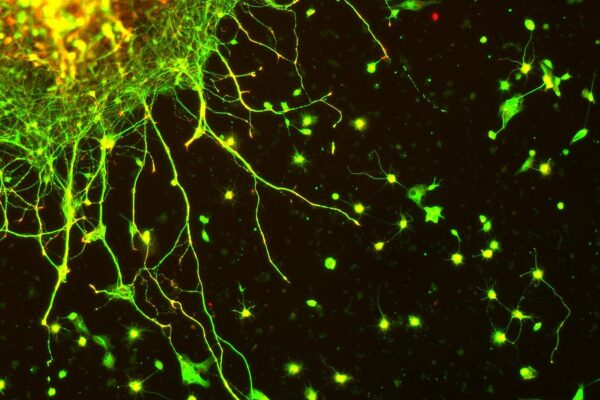

Artificial Intelligence: Enough with the Hype Already

There is nothing intelligent about artificial intelligence. The clue is in the name: artificial. At best, AI mimics intelligence. And such, it fools the more simple minded into believing that AI is a brainiac whereas, in reality, AI is merely good at crunching big data to distil trends and source possibilities.

Binance Teetering

Crypto is having another moment. Binance, the largest exchange for trading the digital currency and its derivatives, is in distress. A dozen senior executives have left and the company fired some 1,500 staff members as trading volumes dropped almost vertiginously. US government agencies, ranging from the Department of Justice to...

Just Released

Africa AI Brazil Business Chile China Climate Corona Davos Debt Development Diplomacy Donald Trump Economy Elections Energy EU Europe Federal Reserve Finance France Germany HiFi History IMF Kamala Harris Military Monetary policy NATO Philosophy Politics Putin Russia Schwab Society South Africa Technology Trade Trump UK Ukraine UN US War WEF