An Old Financial Instrument Gains New Currency

Consols to the Rescue?

When trouble arises, throwing money at it usually works wonderfully well. The problem is, of course, that the number of troubles invariably exceeds the volume of ready cash available.

Thus it was during the corona pandemic, Countries such as Germany and The Netherlands loosened the pursestrings and sprayed the virus with vast volumes of cash. In an event that won’t soon be forgotten, Wopke Hoekstra, Dutch minister of Finance and the time, appeared on television to assure the nation that no expense would be spared to combat the virus and return to normalcy. “Money is no object,” Minister Hoekstra assured his audience.

Both despised and celebrated for his almost legendary stringiness, Mr Hoekstra stunned the nation. Mr Hoekstra’s word was good as gold. Money started flowing freely as the country deployed its formidable reserves and financial firepower. As a result, the economic damage wrought by the pandemic remained fairly limited. Even more impressive, Mr Hoekstra’s largesse did not noticeably increase the national debt or cause a spike in borrowing rates.

Meanwhile at more southern latitudes, governments were desperately clamouring for help. Whilst Spain and Portugal asked politely, Italy – an early epicentre of the viral outbreak – went all but apeshit, demanding money, and lots of it, from the European Union.

Accusations flew back and forth as the southern ire directed its fury to The Hague and Berlin. The Dutch in particular were not amused and gave as good as they received. Diplomatic courtesies went out the window. Italians were soon depicted as womanising wine-guzzling layabouts.

When the dust had settled, and a compromise found, thanks to a timely intervention by Germany, Spanish Prime Minister Pedro Sánchez made a surprise suggestion that had everybody, Mr Hoekstra included, sit up. Mr Sánchez proposed to revisit an old and almost forgotten financial instrument – the ‘consol’ (consolidated stock or consolidated annuities).

A consol is equivalent to a perpetual bond. It was invented and first used by Dutch waterboards in the seventeenth century to raise funds for dikes, levies, canals, windmills, sluices, and drainage ditches. By definition, consols are not redeemable unless the issuer agrees; they merely pay interest and do so perpetually.

Collecting Interest

This was put to the test by the curator of the Beinecke Rare Book and Manuscript Library at Yale University. The good man travelled to The Netherlands armed with a consol from the library collection. He took the consol to the head office of its issuer, the Rhineland Waterboard. Here, he demanded payment of the interest owed and was paid €136.20 on the spot.

The first-ever consol was issued by another Dutch waterboard to rebuild a dike partially destroyed by subsidence. A cosol was duly issued in 1624 to pay for the necessary repairs. That consol is still serviced at an annual interest of 2.5%.

At Prime Minister Sánchez’ suggestion, the European Commission had a closer look at the workings of consols and how the instrument may fit in today’s legal framework. Their conclusion: consols are valid financing vehicles for which there probably is a fairly sizeable market. The commission guesstimates that the European Union could raise about ten percent of its GDP in cash via consols – or about €1.5 trillion, give or take a few billion.

That absolutely staggering sum can solve a great many troubles. The nicest thing about consols is that they do not weigh on the balance sheet. Again: there is no need or obligation to pay back the money owed – not now or ever. Investors are, however, free to trade consols just like they do regular bonds.

For investors it is crucial that the consol-issuer is able to stand the test of time. The Rhineland Waterboard was founded in the year 1255 and remains very much in existence. It manages the waters in an area situated roughly between Amsterdam and the North Sea coast where it keeps around 1.3 million people dry with the help of 372 pumping stations and 10,000 kilometres of drainage ditches and other waterways.

Permanence

In contrast, the EU has been around since 1957 only, and has since changed guises at least twice. On the other hand, the EU has proved remarkably resilient in the face of continued troubles. From the departure of the UK to rebellions in Poland (now pacified) and Hungary (still contrarian), via a major financial/banking crisis sparked in the United States; the arrival of millions of refugees from the Middle East (bombed out of their home by you know who); a devastating pandemic causing societal paralysis; and a hot war along its eastern edge.

The bloc’s demise has been prophesied countless times, curiously enough mostly in the english-speaking world, and yet it survived every calamity and did so stoically and with undeniable panache.

Brussels may be boring as a seat of great power, but that ‘boring’ is a feature of the Union – not a bug. Europe usually fares well when flamboyance is absent. A touch of swagger is more appreciated such as when former commission president Jean-Claude Juncker visited the bombastic Donald Trump in the White House and made himself right at home, being quite unimpressed, much less intimidated, by his host’s bravado.

Back to consols and the most pertinent question: what’s in it for investors? The obvious answer is a steady and predictable stream of income. This is, however, set against a few serious negatives: investors remain exposed – ad infinitum – to the credit risk of the issuer and the erosion of annuities from inflation.

To offer a more enticing deal, some consols can include a ‘growing perpetuity’ whereby the interest rate is adjusted periodically, usually by one percent after each passing decade. This not only boosts returns significantly, but also offers an incentive to the issuer to recall (redeem) the bond.

War & Peace Consols

Consols are more than just marginal esoteric financial instruments and have been repeatedly issues to cover extraordinary state expenses. Great Britain has been active and successful in this space. It issued consolidated bonds to finance both the Napoleonic Wars and the First World War. These consols were traded in London until 2015 when the government redeemed all outstanding bonds. In the US, consols were issued to ward off the country’s first ‘Great Depression’ that started with the ‘Panic of 1873’ and lingered on until the mid-1930s in what later became known as the Long depression.

Today, as Europe prepares to re-equip its military, consols may again be deployed to finance not war but enduring peace by attaining strategic autonomy and reducing its dependence on American arms, regardless who inhabits the White House.

The war in Ukraine has already signalled a paradigm shift in the perception of danger. Before President Putin made his move on the country, few Europeans felt threatened by Russia. Now, few would deny that Russia has designs on Europe and would not hesitate to act if given a chance.

Politicians from Portugal to Poland and Sweden to Spain recognise that the peace dividend has run out and now needs to be repaid. It is estimated that over the thirty-year period since the demise of the Soviet Union, European countries have saved well over €4 trillion on national defence.

That staggering amount can, of course, not be replenished with consols or any other financial instrument. However, spending on defence increased sixteen percent from 2022 to 2023 and is set for a similarly sized jump this year. Since 2014, European military budgets have ballooned by 62% from €330 billion to €552 billion last year.

Consols can be used to for investment in arms design, development, and manufacturing. Long shunned by funds eager to promote now outdated ESG (Environmental, Social, and Governance( standards, the industry is unable to cope with demand and needs vast amounts of cash to expand the production of weapons systems. The boost in defence spending ensures a strong order portfolio well into the future.

The European Union is looking at the possibilities and may yet fully embrace the idea of issuing a series of perpetual bonds to throw the proceeds at the troubles coming from beyond its eastern borders.

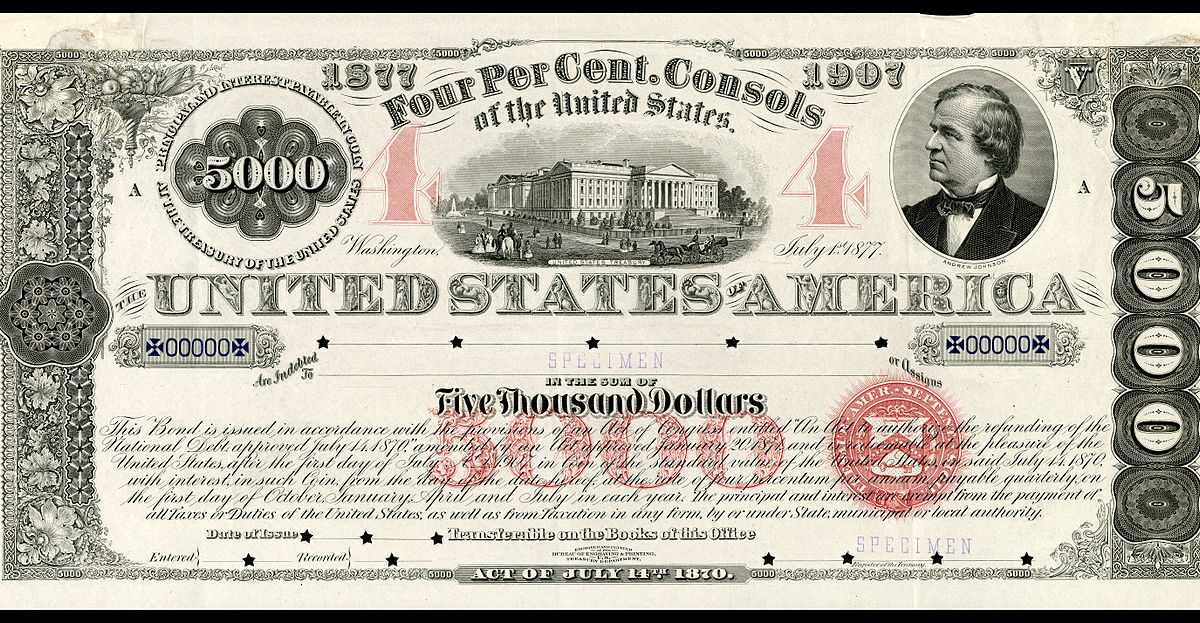

Cover photo: A $5,000 consol issues at 4% interest by the US Government.

© 2013 Photo by National Numismatic Collection of the National Museum of American History.