Common Sense Rules Supreme at Berkshire Hathaway

Warren Buffett

Public speaking: The one essential skill that will see anyone succeed in life. Master this, and your future earnings could easily balloon by fifty percent or more. The advice, often ignored, was given by self-made billionaire investor Warren Buffett in 2009 during a town hall meeting with students at Columbia University in New York. True to style, Mr Buffett offered those present $100,000 cash for ten percent cut of their future earnings; $150,000 for those willing to invest in a course to hone their communication skills. It is not known if there were any takers amongst the participants.

Admittedly, public speaking did not come easy to Mr Buffett – aka the Oracle of Omaha. He repeatedly confessed to ‘great trepidation’ when it came to addressing gatherings during his time at college. Taking a Dale Carnegie course changed that for the better. In fact, Mr Buffett’s diploma from the author of How to Win Friends and Influence People is the only plaque displayed at the Omaha office from where he rules the Berkshire Hathaway business empire. The Bachelor of Science degree in Business Administration he secured at age nineteen from the University of Nebraska is conspicuously absent.

However, it was another book that set the young Warren Buffett on the way to success: One Thousand Ways to make $1000, a 1936 tome sourced from his father’s office, inspired him to experiment, peddling assorted wares door-to-door in the neighbourhood and squirrelling away a tidy sum in the process. The book, long out of print, has since become a sought-after classic amongst the legions of investors hanging on to Mr Buffett’s every word in the hope of finding the key to riches.

Compound Interest

That key is the oft-underappreciated power of compound interest – one of the book’s recurring themes. The stuff of legend: age eleven, Warren Buffett put his savings – a grand total of $114.75 – in the stock market, acquiring three preferred shares in Cities Services, a now defunct natural gas company.

By some calculations, that modest sum invested in a no-fee index fund (not yet available back in 1942) would have grown to well over $600,000 by 2020. As Mr Buffett candidly pointed out in one of his letters to investors that the same sum invested in gold would have grown to just $4,200 – or less than one percent from an unmanaged bet on US business: “The magical metal was no match for the American mettle.”

Mr Buffett has always been bullish on the American economy – and continues to be so as evidenced by his recent $51.1 billion splurge on US stocks, including Citigroup, Occidental Petroleum, Paramount Global, and others. He regularly mentions The American Tailwind as the main propellant of his enduring success as an investor. That tailwind represents the entire dynamics – less politics – of the US economy and the society that drives it.

Acknowledging that government debt is a poor parameter to judge a nation’s progress, Mr Buffett instead points to the Federal Reserve’s estimation of US household wealth – a truly staggering $108 trillion. That volume of wealth is described as ‘retained earnings’ – a crucial concept in Mr Buffett’s investment strategy and one that helps explain the tailwind: an unfathomable deep well of resources that gives US entrepreneurs access to the capital needed for continuous innovation, expansion, and disruption.

The American Tailwind

Rather than ascribing his success to a singular business acumen or any esoteric investment strategy, Mr Buffett recognises that he and his long-time friend and partner Charlie Munger, vice-chairperson of Berkshire Hathaway, have merely benefitted from the tailwind. The celebrated investor is famously uninterested in politics.

In his 2019 letter to Berkshire Hathaway shareholders, he reminded readers that since 1942, the United States has had seven Republican and seven Democrat administrations: “While they served, the country contended at various times with a long period of viral inflation, a 21% prime rate, several controversial and costly wars, the resignation of a president, a pervasive collapse in home values, a paralysing financial panic, and a host of other problems. All engendered scary headlines: All are now history.”

The sage advice: Don’t bet against the resilience of the US economy. Instead, ignore the chatter and trust business to consistently turn a healthy profit. The system, as Mr Buffett sees it, always finds a way to either solve or workaround any given problem. The optimist is, as a rule, rewarded with solid returns.

Thus, it is that Berkshire Hathaway, Mr Buffet’s business conglomerate and the fourth-largest company in the world, maintains an exceptionally long investment horizon. The analysts’ usual fixation on quarterly earnings is pointless. Explaining his early 2018 acquisition of an additional 75 million shares in Apple, Mr Buffet dismissed concerns about the company’s disappointing sales: “Nobody buys a farm based on whether they think it’s going to rain next year. They buy it because they think it’s a good investment over ten or twenty years. The idea that you’re going to spend loads of time trying to guess how many iPhones X, or whatever it may be, are going to be sold in a given three-month period totally misses the point.”

Value Investing

Mr Buffett is widely credited with introducing the notion of ‘value investing’ to the public, advocating for investment in companies with solid earnings and long-term growth potential. He also appreciates companies that pay out a decent dividend to shareholders and those that can admit and disclose their mistakes.

Most important of all: Mr Buffett will not invest a dime in companies whose business case he finds hard to grasp. That nugget of down-to-earth philosophy helped steer Berkshire Hathaway well away from to dot-com bubble burst of the early 2000s. Proud and sensible Luddites, Messrs Buffett and Munger eschew novelty from novelty’s sake. Instead, Berkshire Hathaway seeks to establish a company’s intrinsic value by projecting future earnings and discounting these to present-day levels. Ignoring short-term market moves should allow the investor to focus on long-term returns. The exceptions happen, of course, when the stock of a company with solid fundamentals suffers a notable drop in its share price – which signals an opportunity to snap up a few more shares at a discount.

In essence, and shorn of all adornments, value investing equals the search for publicly held companies whose stock is undervalued for no apparent reason. Mr Buffett takes this philosophy a step further by adhering to the efficient market hypothesis (EMH) which holds that markets always know best and trade stocks at their fair value. Of course, EMH makes it hard, if not impossible, to identify and buy stock that is undervalued, given that the hypothesis eliminates such irregularities.

This is the exact point at which Berkshire Hathaway appeals to common sense in determining which company is well-run and has plenty of upside potential. There is, as such, no magic involved. It boils down to a difference in approach: the conscious choice not to seek capital gain, but to build a stake in quality companies capable of generating good earnings.

Voting Machine

The current market, apparently rudderless but drifting south, is akin to the ‘voting machine’ Mr Buffett warned about when paraphrasing the British inventor of value investing Benjamin Graham. In the short run, Mr Graham found, the market is a voting machine, but in the long run it is a weighing machine. Mr Graham’s 1949 book The Intelligent Investor has provided Mr Buffett with a lifelong guide to the stock market. The work introduces a sharp distinction between investing and speculation. Its author concludes that the intelligent investor is one who does not participate in the market’s follies but merely profits from them.

Speaking at the annual meeting of Berkshire Hathaway in April this year, Mr Buffet likened the present state of US financial markets to a casino after millions of new traders entered the system – often spurred into opening brokerage accounts by covid lockdown boredom. The pace of trading has increased considerably and ready access to options markets has enticed many to place leveraged bets on the rise or fall of iconic companies such as Apple or Tesla – often cashing in or out on minute fluctuations as would do Mr Graham’s speculators.

Taking a cue from the master’s master, Messrs Buffett and Munger used market follies to place their own mega bets such as acquiring a fourteen percent stake in Occidental Petroleum in just two weeks’ time. Both men did, however, express their disgust at day traders and their brokers for using blue chip stocks as poker chips.

Just before the ‘Woodstock for Investors’ got underway in Omaha, libertarian tech investor Peter Thiel inveighed against the reigning finance gerontocracy’. The co-founder of PayPal, Palantir Technologies, and angel investor in Facebook launched an incendiary attack on the forces that – he thinks – deliberately seek to surpress bitcoin in an attempt to preserve their own power.

Crypto and fintech, Mr Thiel said, constitute a movement and it’s a political question whether this movement is going to succeed, or whether the enemies of the movement are going to succeed in stopping it. He singled out Mr Buffet as ‘enemy number one’ but also named and shamed JP Morgan Chase CEO Jamie Dimon and BlackRock CEO Larry Fink.

Mr Thiel claimed that the campaign against innovation in finance prevented bitcoin from rivalling gold as a hedge against inflation and predicted that the value of crypto could soon match that of all public equities – or some $115 trillion.

Buffett on Crypto

“People attach magic to lots of things and one of them is bitcoin.” Mr Buffet admitted that he is clueless as to the future value of bitcoin. “Whether it goes up or down over the next five years, I do not know. But I’m pretty sure that it doesn’t produce anything.”

“If you said, for a one percent interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon. For $25 billion I now own one percent of the farmland. If you offer me one percent of all the apartment houses in the country and you want another $25 billion, I’ll write you a check, it’s very simple. Now if you told me you own all of the bitcoin in the world and you offered it to me for $25. I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent and the farms are going to produce food.”

To have value, assets, Mr Buffet continues, must deliver value to somebody. And that value is expressed in dollars: “We could, conceivably introduce Berkshire coins but in the end, it’s dollars that count. Moreover, the is no reason in the world why the US government is going to let our coins replace theirs.”

Less given to embellished talk and more acerbic in his statements, Mr Munger accused crypto in general and bitcoin in particular of undermining the US Federal Reserve System. “Also, it makes us look foolish in comparison to the communist leader in China who was smart enough to ban bitcoin.”

The recent crash in the value of bitcoin underscores the sage-like wisdom of the investment duo from Omaha. The present crypto bear market prompted billionaire bitcoin investor Mark Cuban to tip his hat to Mr Buffett: “He was right. It’s only when the tide goes out that you discover who has been swimming naked.” Terra, Celsius, Three Arrows Capital and, more recently Coinbase, are amongst the crypto players that have been caught short. However, Mr Cuban does not despair and thinks the downturn may have a purifying effect, ridding the crypto universe of bad apples.

Succession

A big question mark hovering over the $500 billion (or so) business empire Messrs Buffet (92) and Munger (98) built concerns the inevitable. Plans are afoot to split the top job at Berkshire Hathaway into three separate functions in the post Buffett-Munger era: a CEO to steer capital allocation, an investment manager to handle the company’s stock portfolio, and a chairperson of the board.

Speaking to CNBC in early 2020, Mr Buffett confirmed that should ‘something happen’ to him, Vice-Chairperson Greg Abel (59) would take over. Mr Munger assured all that Mr Abel would ‘keep the culture’ of the company. The course of the succession, reportedly already decided in 2012, had been kept a close-guarded secret and became one of the few issues that both captivated and annoyed shareholders.

Mr Abel oversees Berkshire Hathaway’s non-insurance investments. He arrived at the company via CalEnergy which Mr Abel transformed from a bit player in the California upstream oil and natural gas business into global force of note with offshore gas assets in Australia, Poland, and the UK. In 2000, after CalEnergy was absorbed into the Berkshire Hathaway constellation, Mr Abel was put in charge of the company’s energy unit where he promptly was awarded the opportunity to further hone his dealmaking skills.

An $18 Billion Blemish

Mr Abel’s division soon became known for its prowess in quick takeovers. In 2005, it acquired PacifiCorp in a $5.1 billion deal followed by the $10.4 billion purchase of the Nevada power company NV Energy and the $8 billion buyout of Dominion Energy’s pipeline business last year. However, a few of the more sceptical Berkshire Hathaway shareholders point to the 2017 failed $18 billion bid for Oncor Energy as proof that Mr Abel is perhaps less savvy and nimble than Mr Buffett.

As the company’s future CEO, Mr Abel may face considerably more pressure from shareholders. Mr Buffett plans to donate most of his wealth to charity. His class-A stock with preferential voting rights (representing 32% of the vote) has so far limited activist investors to voicing their opinion (on, say, environmental standards and climate change) before being ignored. Upon his death, Mr Buffett’s holdings will be converted to class-B and stock that are likely to end up being traded by new shareholders potentially less willing to be silenced by upper management.

Berkshire Hathaway has so far been reluctant to disclose and detail its efforts to address climate change and promote diversity and inclusion across its 360,000-strong workforce. Last year, the company successfully urged shareholders to vote down two proposals that would have forced it to prepare annual reports on climate-related risks and disclose its hiring policies.

The Berkshire Hathaway board argued that it only maintains a ‘notoriously small’ central office staffed by just 26 people which manages the company’s interests in an ‘unusually decentralised’ way.

Thrifty

Although shareholders do, at times, grumble at the excessive remuneration of Berkshire Hathaway top execs such as Mr Abel, whose pay package topped $19 million last year, Mr Buffett maintains a famously frugal lifestyle. He draws an annual salary of just $380,000 and until last year lived in the same house he bought in 1958 for just $31,500 ($285,000 in 2020 dollars).

For breakfast, the billionaire usually turns to McDonald’s on his five-minute commute to work. Mr Buffett once remarked that he studied the actuarial tables of his insurance companies and found that the lowest death rate is amongst six-year-olds: “So I decided to eat like a six-year-old. It’s the safest course to take.”

His long-time friend Bill Gates of Microsoft fame recalled in 2017 how Mr Buffett paid for their fast-food lunch with coupons. During a Q&A session with business students, the investor summarised his philosophy: “You can’t buy health and you can’t buy love. I’m not interested in cars, and my goal is not to make people envious.”

Warren Buffet’s Biggest Mistake

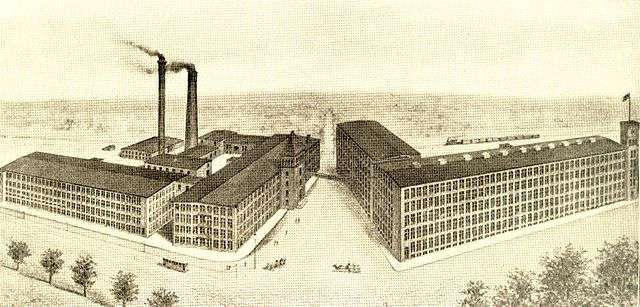

Berkshire Hathaway started its corporate life in 1839 as the Valley Falls Company in the eponymous Rhode Island town. In 1955, after a string of mergers, Berkshire Fine Spinning Associates joined up with the Hathaway Manufacturing Company to form an industrial behemoth of fifteen plants employing some 12,000 workers and $120 million in annual revenue.

In 1962, Warren Buffett bought his first Berkshire Hathaway stock after noticing that it wobbled each time the company closed a textile mill. He gradually expanded his stake in the company but frequently clashed with its CEO Seabury Stanton who eventually offered to buy back Mr Buffett’s stock. However, his lowball tender caused Mr Buffett great indignation and prompted him to turn the table on his nemesis, acquiring additional stock instead, and see Mr Stanton fired.

In later years, Mr Buffett would regret his youthful passion. In 2010, he commented that buying Berkshire Hathaway – a failing textile business – was his biggest-ever investment mistake which cost him an estimated $200 billion in denied compound returns over the following 45 years. The last Berkshire Hathaway textile mill was shuttered in 1985.

Now one of the world’s biggest holding companies, the enduring success of Mr Buffett’s ‘mistake’ may be ascribed to its vast interests in the insurance industry which generates a considerable float – money paid in premiums that has yet to be employed to cover claims. This cash reserve is on hand to be invested and amounted in 2021 to a rather staggering $147 billion.

The float enables Berkshire Hathaway to move quickly and decisively whenever an opportunity arises. It is how the company in 2002 bought struggling clothing manufacturer Fruit of the Loom for just $835 million in cash after its stock lost more than 97% of its value. The move was followed by additional purchases that ridded Fruit of the Loom of its main competitors and allowed the company to return to profit. Moving manufacturing plants to Honduras and other low wage jurisdictions also helped boost the bottom line.

Mr Buffett is a strong believer in the power of dividends as the investors’ secret weapon. Berkshire Hathaway holds large positions in the most generous Fortune 500 companies such as Apple, American Express, and Coca-Cola which have a solid track record of paying regular and steady dividends. Coca-Cola, to name but one, has increased its annual dividend for 55 consecutive years.

Although Berkshire Hathaway takes in dividends, the company doesn’t pay any to its shareholders, preferring instead to reinvest the proceeds. The company only once, in 1967, paid out a ten cent dividend per share. To this day, Mr Buffett maintains he must have been in the bathroom when the pay-out was authorised.

Cover photo: Warren Buffet detailing and explaining his investment philosophy.

- © 2023 Photo book Benjamin Graham by Prabhat Prakashan

- @ 2013 Photo Warren Buffett by Fortune Live Media

- © 2016 Photo Peter Thiel by Heisenberg Media

- © 2023 Image Berkshire Hathaway cotton mill by New England Historical Society